- Fintech Friday

- Posts

- Silicon Valley Bank Shutdown: Implications for Startups and VCs

Silicon Valley Bank Shutdown: Implications for Startups and VCs

Lessons from Jason Calacanis’ Emergency Podcast

Jason Calacanis, the prominent Silicon Valley investor, recorded an emergency podcast on Friday afternoon in response to the recent news of Silicon Valley Bank's shutdown.

In the podcast, he explains the gravity of the situation and the implications for the tech industry.

This is a summary post of what he had to say.

📖 The Main Story

"Early in my career, my Chief Operating Officer, Elliot Cook, who was much older than me, taught me to keep money in three different accounts in case of a bank run or other unforeseen events that could prevent access to cash. It's taken me 30 years to realize how right he was. I had never seen this happen before where people could not get access to cash they had in a super credible bank."

Silicon Valley Bank's shutdown is causing chaos in the tech industry. It's one of the fastest-moving and most impactful stories in Silicon Valley, with many successful companies and venture firms being affected. This is the most chaos seen in Silicon Valley since the 2008 financial crisis and the dot com crisis.

Silicon Valley Bank (SVB) services nearly half of all US venture-backed tech and life science companies, and its shutdown has resulted in many startups and venture capitalists being unable to access their funds.

Prior to Friday, Silicon Valley Bank's stock had dropped 60% due to news of a balance sheet rebalancing by the CEO. There had been rumors of balance sheet issues prior to this.

Trading on the stock was halted on Friday, and around noon Eastern, the Federal Deposit Insurance Corporation (FDIC) shut down Silicon Valley Bank. The bank went from a 16 billion dollar market cap to being shut down entirely in two days.

The FDIC has said it will pay uninsured depositors at SVB an advance dividend within the next week. Uninsured depositors will receive a receivership certificate for the remaining amount of their uninsured funds. As the FDIC sells the assets of SVB, future dividend payments may be made to uninsured depositors.

However, the limit of FDIC insurance for businesses is only $250,000, so any uninsured funds above that amount will not be immediately accessible. The timing of liquidating the bank's assets remains uncertain.

It is uncertain whether the situation will be as bad as some fear. Calacanis believes there is an 80-90% chance that Silicon Valley Bank will be rescued this weekend, likely by Goldman Sachs or JP Morgan, and that everything will return to normal in a matter of days or weeks. Depositors' money will be taken care of.

However, there is also a non-zero chance, say 10-20%, that this could have a severe impact. In such a scenario, people would not have access to the funds they have on deposit, which would cause significant downstream impacts.

Calacanis explains the options:

If there were a large unwind where they were selling assets, such as from desks or office buildings, the wine collection they have (Silicon Valley Bank is famously the bank for the wineries up in Napa and Sonoma), it could take a long time to liquidate everything.

Of course, there are going to be treasuries, equities, and all kinds of loans, and this is where unpacking this becomes complicated.

If it has to occur through the FDIC and liquidation, this could take years and be incredibly painful.

If someone comes in and buys it, then everybody should have their money up and running very quickly.

"I'm hoping that one of two things happens here: a large bank with a big balance sheet buys it and makes sure that everybody who has cash in there has access to it, or the government comes in and backstops it."

The Consequences:

Many companies may be at risk of not making payroll in the next two to ten weeks, and collectively, they have tens of thousands of employees who are in danger of not getting paid.

"What scares me the most is that there are companies that were solvent, right? We spent the last 15-18 months working out our portfolios and investments. All of the companies that weren't going to make it, or needed to cut half their staff, needed to raise emergency funding (bridge rounds). All of that was for the companies that were broken, that didn't have product-market fit, that were overspending."

"Then we had a group of companies that had either been profitable, had 50 months of runway, or had raised money at the right time, and they were sitting pretty with huge bank accounts filled with cash that they now can't access. So now they get put in the bucket of troubled startups."

🤨 How We Got Here

2020 and 2021 were the most ridiculous investment years since the dot com era. These were record years not just for startups raising money but also for VCs.

there was a ton of liquidity sloshing around everybody was making money and we were in a zero interest rate environment.

money was being funnelled into projects like NFTs, crypto, and legitimate SaaS businesses that became worth more money, so they got higher multiples than they should have and VCs were making money.

the party was in full swing VCS raised larger funds because their LPS are making larger returns and everybody's making bigger bets and that's logical but it obviously got overheated

the funds were getting larger and larger especially compared to the amounts raised in 2012 and 2013.

according to the Pitchbook-NVCA Venture Monitor, in 2021 VCS raised a record 154 billion dollars from LPs.

As the amount of money being raised increased, VCs raised larger funds and invested earlier in startups.

"As the amount of money being raised increased VCs were like you know what? instead of you raising a seed round why don't we just have you go straight to Series A or instead of you raising a Series B when you get to 5 million dollars in Revenue let's do it when you're at 2."

Startups raised more money to compete in a talent war caused by low interest rates, resulting in a record-breaking $344 billion in VC capital going into startups in 2021.

This resulted in startups hiring more people before achieving product-market fit, leading to many startups being overfunded.

Given all of this, many funds startups and funds created large deposits at Silicon Valley Bank.

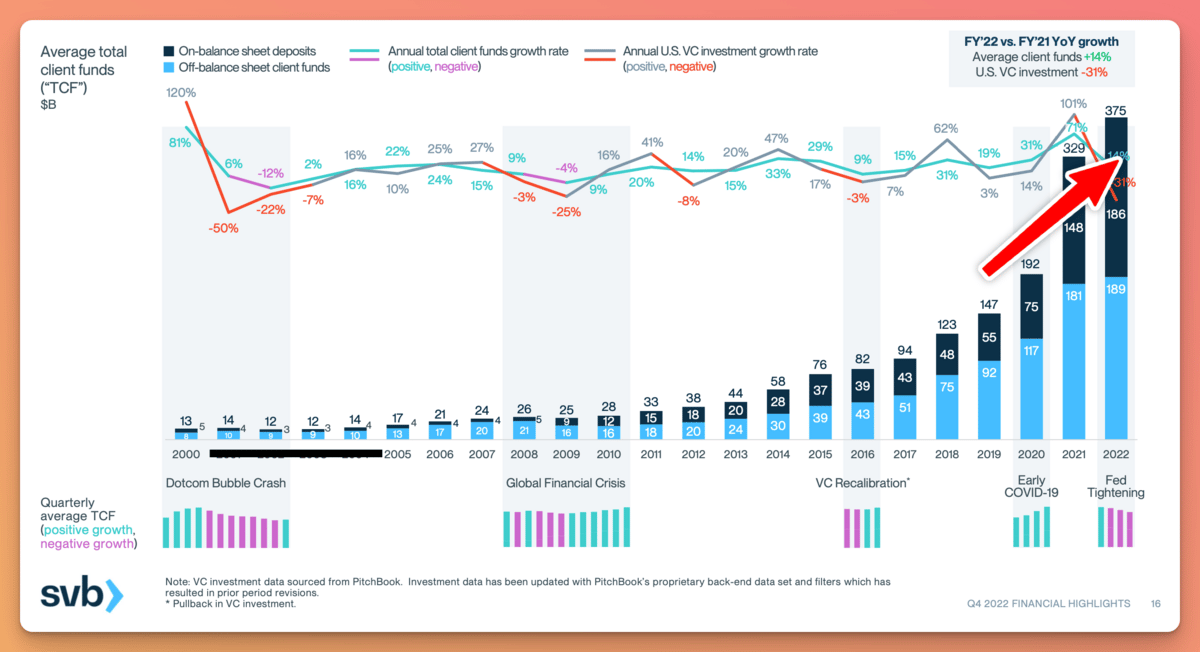

The bank's deposits jumped ~3x from 2019-2022, and many large deposits were made by venture-backed startups.

Thus, Silicon Valley Bank was sitting on large sums of capital. However, due to the low interest rate environment, they were unable to generate favorable yields through loaning out their cash.

Instead, they purchased over 80 billion dollars in mortgage-backed securities (MBS) and US Treasuries, which are considered to be some of the safest places to invest money.

They bought long-duration US Treasuries at low interest rates and held them. However, when the Federal Reserve raised interest rates at a faster pace than expected, the value of their holdings declined on paper.

While holding these securities to maturity is not a problem, but selling them at a loss is what could cause significant financial issues. If the losses were large enough, SVB may not have enough money to pay out all depositors.

Silicon Valley Bank was in the process of rebalancing their portfolio when the paper losses occurred, and if all of their clients withdraw their funds, it could cause further problems.

🔫 The Trigger

On March 8th, SVB announced that it had sold all of its available-for-sale securities with the intention of reinvesting the proceeds; they were rebalancing their balance sheet and trying to get away from those long-dated bonds.

This $21 billion sale would result in a post-tax loss of $1.8 billion in Q1.

The bank was trying to rework the balance sheet, and that made everybody panic.

To offset the loss, they also announced that they would raise $2.25 billion by issuing shares, with $500 million committed by General Atlantic.

"With this announcement, Silicon Valley Bank essentially hit the starter's pistol for the bank run. They basically told the market, "Hey, we got problems," which made everybody scared."

On Thursday, SVB's CEO, Greg Becker, sat on a 10-minute call with top clients and VCs and said “I would ask everyone to stay calm and to support us just like we supported you during the challenging times". However, this statement raised concerns that things were not good.

📉 The Impact on Startups

SVB's shutdown has caused chaos in the tech industry, and many startups and venture capitalists are unable to access their funds. This has resulted in a lot of uncertainty and fear among startup founders, who are now facing the possibility of not being able to make payroll.

Startups that have SVB as their treasury can't get access to their funds, which means they are unable to pay their employees or suppliers.

💸 The Impact on Venture Capitalists

The shutdown of SVB has also impacted venture capitalists, many of whom have their LP funds or investment dollars at SVB. This has resulted in many venture capitalists being unable to fund their portfolio companies.

Calacanis believes that any funding that was going to occur or any discussions that were going on, will probably be delayed for at least 60 days.

🧠 Questions & Answers

The following questions were asked during the podcast. Read the full answers here.

Should the government come in and backstop this?

What are your thoughts on emergency funding sources, accelerated recaps, etc.?

How does Silicon Valley Bank affect Founders trying to raise seed rounds right now?

What happens to companies with credit facilities if they just void?

What is the impact for startups that have venture debt?

Regarding Silicon Valley Bank, are all the employees still there?

How does this compare to 2008 and what lessons can be taken from that?

Will Stripe's attempt to raise 6 billion get hurt by this SVB fiasco?

Do you expect companies to start laying off immediately or will they wait a few weeks?

Will it trickle over to other banks?

What about companies with more than $250K in deposits? 93% of funds are not insured.

SVB manages over 250 funds on our behalf in a market account at JP Morgan. What do you think is going to happen with that?

What happens to Silicon Valley Bank shareholders? Do they get anything back?

What do you think about the realization of $15 million losses for the acquirer?

What do you think about the CEO of SVB selling 3.5 million in stock in the last two weeks?

Are founders allowed to file a lawsuit against SVB?

How much SVB is in the red?

What happens to SVB loans to tech companies?

What happens to General Lennox's $500 million private investment now that the FDIC has taken over?

💬 If you have any feedback or suggestions for future topics, please don’t hesitate to reach out. Follow me on Twitter to stay in touch.